The psychology of tax payments

What does the new tax regime mean for mutual funds adoption?

It was 2016, and I had just travelled from Bangalore to my hometown of Erode in Tamil Nadu for the state elections. I was excited to cast my vote and even invited my friend R to accompany me. But to my disappointment, R declined, saying that he didn't see a compelling reason to make an effort to travel and vote.

A few weeks later, R was eager to take me to a new restaurant in Indiranagar, Bangalore, serving delicious rolls and kebabs. We indulged in a mouth-watering meal, and as soon as we were done, R pulled out the Zomato app and started writing a detailed review of the restaurant. I was taken aback and asked him why he was so invested in writing this review. He replied that he had discovered great restaurants in the past through Zomato reviews, and now it was his time to pay it back.

That's when I asked him why he didn't find the same motivation to travel and vote in the elections. He replied that he didn't see the impact of his vote in terms of reforms and therefore wasn't motivated to make an effort. This encounter left me pondering the dynamics of motivation and the power of perception.

In social psychology, this behaviour is called effort justification, which states that an individual's perception of the rewards gained from a particular task (in this case, writing a Zomato review) can influence their motivation to engage in that task, despite the effort required to do so.

Effort justification also plays a crucial role in how we perceive tax payments to the government. We feel our money is going to a ‘black hole’, unaware of the reforms and changes that our taxes can bring. Please note, It’s just a perception and not a reality. This leads to a low motivation to pay taxes, as we don’t feel the direct impact of our contribution. People are more likely to be motivated when they know the purpose and gains of their actions.

How to read this post?

If you are new to the ideas around tax savings and mutual funds, read from the beginning:

Effort Justification

80c enters the chat

The ELSS way of saving taxes

A new tax regime enters the chat

Budget 2023 edited the previous message

If you are a tax and finance expert, jump directly to these sections:

What Does the New Tax Regime Mean for Mutual Funds Adoption?

The Tax Talk: Will We Ever Be Satisfied?

Effort justification:

Okay, now, for people who are in India, how do they deal with the effort justification?

In India, many individuals feel the pinch of taxes on their salaries as they move up the career ladder. To deal with this, they often explore ways to minimize the taxes they pay to the government. This is because taxes can be perceived as a loss of income, and individuals tend to be more motivated to avoid losses than to seek gains. This phenomenon is known as loss aversion.

Loss aversion refers to the psychological tendency for people to feel more incredible pain from losing something than pleasure from gaining the same thing.

This is when individuals look for ways to minimize their tax liability, such as through tax-saving investments or other legal means.

‘If I'm giving 25% of my income to the government, then I'm basically a slave to the government between Jan and March’ I heard this quote on a Seen and the Unseen podcast episode

80c enters the chat.

The Eureka moment when individuals feel the pain of paying excessive taxes is when they come across terms like 80c, ELSS, and tax-saving mutual funds for the first time.

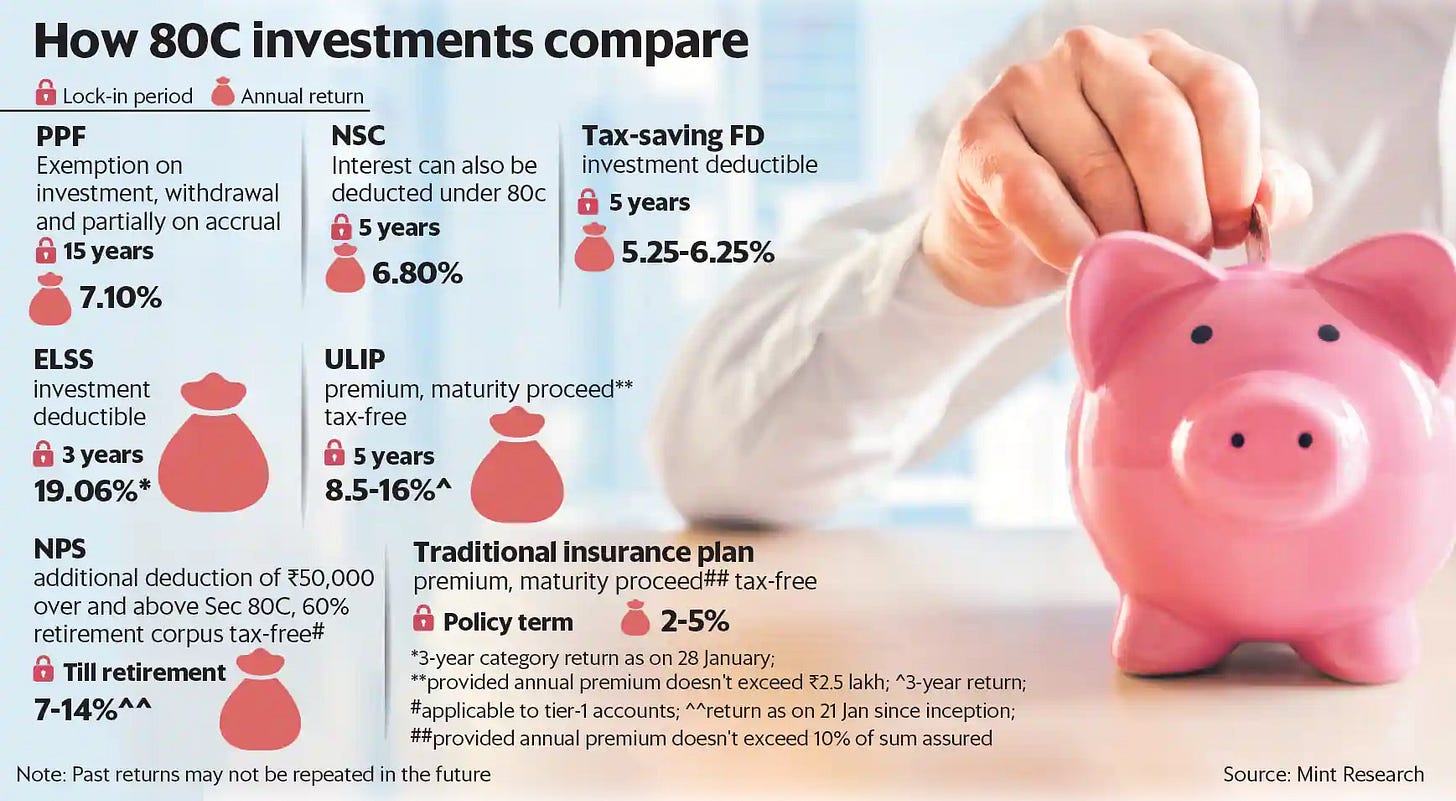

For starters, the 80C provision in the Indian Income Tax Act is a way for taxpayers to lower the amount of tax they need to pay. Individuals could reduce their taxable income up to 1.5 Lakh rupees by investing in one of the below ten categories.

If you got an uncle sporting pants high above his waist who visits your home occasional,ly with a bundle of LIC pamphlets encouraging you to invest for tax savings? He's most likely talking about the 80C provision in the Indian Income Tax.

The ELSS way of saving taxes

I want to delve into saving taxes through investing in mutual funds in this newsletter. Equity Linked Savings Scheme (ELSS) is a type of mutual fund that offers a tax exemption under the 80C provision up to a limit of INR 1.5 Lakhs. With a three-year lock-in period, ELSS is an attractive option for many salaried employees who are just starting their journey in mutual funds and the stock market.

The fundamental motivation behind investing in ELSS is to reduce the tax burden while potentially earning higher returns that beat inflation. This makes it a compelling proposition for anyone looking to make their money work for them.

A documentary on ELSS can be titled 'Orey kallula rendu maanga' [Tamil] or 'One stone two mangoes' [English] if it is streamed on Netflix.

One key feature of ELSS is its three-year lock-in period, which not only offers benefits through tax exemptions under Section 80C but also provides an opportunity for new investors to reap the rewards of long-term investments without the temptation to liquidate. By entering the stock market through ELSS, individuals can gain valuable experience and begin their journey in a disciplined manner, making it an intriguing proposition for those seeking to invest their money. India’s mutual fund penetration is nascent and has a lot of legroom to grow.

Well, now this all looks good. What is the problem?

A new tax regime enters the chat:

In 2020, the Finance Minister of India, Nirmala Sitaraman, introduced a new taxation regime that offered lower-income tax slabs but with some conditions. The choice between the two regimes is optional, but once you opt for the new one, you can no longer switch back to the old one.

So, what's the catch? The new regime requires individuals to forgo exemptions and deductions like 80c, which were available under the previous regime. The old regime still allows you to save on income taxes through deductions, while the new regime offers lower tax rates without these deductions.

Now focus

Budget 2023 edited the previous message:

As this year’s budget announcement approached, many anticipated an increase in the 80c slab limit of 1.5 Lakhs, which has remained unchanged since 2014. However, when the Finance Minister unveiled the changes to the personal income tax, the focus was solely on the new tax regime, which operates without deductions.

Starting next year, the new tax regime will become the default option, and individuals will have to opt-out to choose the old rule. This move by the government clearly signals their preference for a more straightforward tax calculation process. It could indicate that the old regime with deductions may eventually be phased out.

What Does the New Tax Regime Mean for Mutual Funds Adoption?

With the government potentially phasing out the old tax regime that included deductions, what impact will it have on mutual fund adoption? The answer lies in the consequences that come with it.

The disappearance of the ELSS mutual fund category, which offered tax benefits under 80C, could result in three potential outcomes:

The decline in Savings: Without the nudge to invest in savings instruments, a generation may spend more and save less. With personalized advertisements and seamless payment options at our fingertips, excessive consumption can become a reality. While this may benefit the economy, it can harm an individual's financial well-being.

Shift to Conservative Investments: Indians have a long-standing affinity for real estate and gold. Eliminating mutual funds as a savings option could result in more individuals sticking to these traditional assets.

Attraction to High-Risk Investments: The promise of "double your money" has always been a tempting offer for inexperienced investors. It's possible that without the option of less risky investments like ELSS, individuals may be more susceptible to falling for high-risk, high-return options.

It's important to note that these are just hypotheses, but it's worth considering the potential impact of the new tax regime on the investment behaviour of individuals.

In investing, it's not uncommon for the promise of quick profits to outweigh the probability of failure. This is due to a behavioural phenomenon known as present bias, where people value immediate rewards more highly and discount future tips. In investments, the allure of quick gains from cryptocurrency may seem more attractive to some compared to the slower but more reliable returns of mutual funds.

The culture of instant gratification, where individuals expect quick and efficient outcomes, will impact investment behaviours and expectations in future.

The Tax Talk: Will We Ever Be Satisfied?

As we move forward, it's widely speculated that the new tax regime may offer more incentives. For example, this year, the minimum income limit for tax paying was raised from INR 5 Lakhs to INR 7 Lakhs, and the limit could be pushed further in the coming years. But will this shift our views on paying taxes?

The truth is human nature tends to adapt and return to a baseline of dissatisfaction, even in the face of positive change. This phenomenon is known as Hedonic Adaptation.

Ultimately, it's not just about the amount of tax paid but what we receive in return for that tax that matters. What is your view on paying taxes to the government? Let me know in the comments below.