What Indian Consumers Want in 2026?

A founder's failure, five consumer themes, and a quiet restart

A friend of mine had a brutal stretch few years back. Moving countries, a new job, and losing his father and grandmother - all while trying to hold it together. He’s one of the few people I can talk to without filters, which made me wonder: if I were in his place, would I hold up - or fall apart?

I asked him how he manages adult life without giving up.

He said two words: “Life happens.”

He didn’t need to explain further. I instantly got it.

You can have elaborate plans for how a year should unfold, how a quarter should perform, or how a relationship should evolve. But at the end of the day, life happens. Eventually, you just have to buy a popcorn, sit in the front row, and watch your life in IMAX. As a spectator, your options dwindle fast.

2025 was that kind of year for me.

Professionally, almost everything that could go wrong did. I raised money, built a product, pivoted more than once, tried selling, hired a team - and failed to pull it all in the right direction. Ten months in, the startup collapsed like a house of cards. Ironically, someone obsessed with consumer research couldn’t build a product that consumers wanted. Funny. And true.

Exactly 120 days ago, I shut down the product and found myself jobless. (I know the exact count because I started a Duolingo streak the next morning). I tried the “rest” playbook - travel, meditation, and mindless scrolling. It didn’t work. The void remained. What bothered me wasn’t failure. It was the absence of momentum. Purpose, it turns out, is a better antidepressant than rest.

So I went back to two things I’ve always loved: research and writing. This newsletter was never meant to be more than a hobby project - a place to share observations about India’s evolving digital consumer. I had no expectations. But writing again did something unexpected. Every comment, every subscription, every note of appreciation brought back confidence. One edition even found its way into Ben Evans’ newsletter.

Naval Ravikant once said,

“Do what feels like play to you, but looks like work to others.”

To everyone who paused their scroll for my words this year: thank you.. Your attention gave me a direction when I felt lost. Now getting back what I truly wanted to share in this post.

Themes I’m excited about in 2026

Sachet subscriptions

Banking with a vibe

AI family member

Bringing back a purpose

Discipline monitor

1. Sachet subscriptions

Everyone talks about how the digital native Indians are comfortable with UPI and digital payments. But I look at it through a different lens: the psychology of discretionary spends. I call it “bare minimum throwaway money” - the amount a consumer is willing to risk to experiment with a new product without thinking twice. In India, that magic number is between ₹100 and ₹250.

Where does this number come from? It is the cost of an evening snack, a meal, or an auto ride. The real shift is how little people need to think before paying. Once a product lives inside that mental bracket, the conversation changes. It’s no longer “Is this worth it?” It becomes “Let’s see.”

That’s where things get interesting.

Low-ticket pricing, combined with UPI auto-pay, has opened up an entirely new set of business models. You see it in English learning apps, micro-drama platforms, social and companion apps. We are seeing this work brilliantly with apps like Seekho, SpeakX, Lokal and FRND. They offer services with high perceived value - like learning a language or upskilling - for a nominal monthly fee.

With AI the economics works out at scale. It lowers the cost of creating content, testing creatives, and iterating fast. Meta ads becomes the acquisition layer. The user loop is simple: bombard them with short-form ads, funnel them to the app, and close the sale with a ₹1 trial. If the user sees value, the auto-pay kicks in. If they don’t, the loss is negligible.

What fascinates me is that the exact product almost feels secondary.

This model works because the alternatives are worse. For example you can learn English passively on YouTube, or actively in a tuition class that’s expensive and time-consuming. The middle ground - cheap, active, immediate - is where these products live.

And once you see this, you start noticing a pattern.

Instead of founders chasing one massive app, you see app studios emerging. Kutumb, Eloelo, Lokal, Seekho. Teams building multiple small apps, each one a bet, each one playing in that sachet-sized price range. Individually, they do a few million dollars.

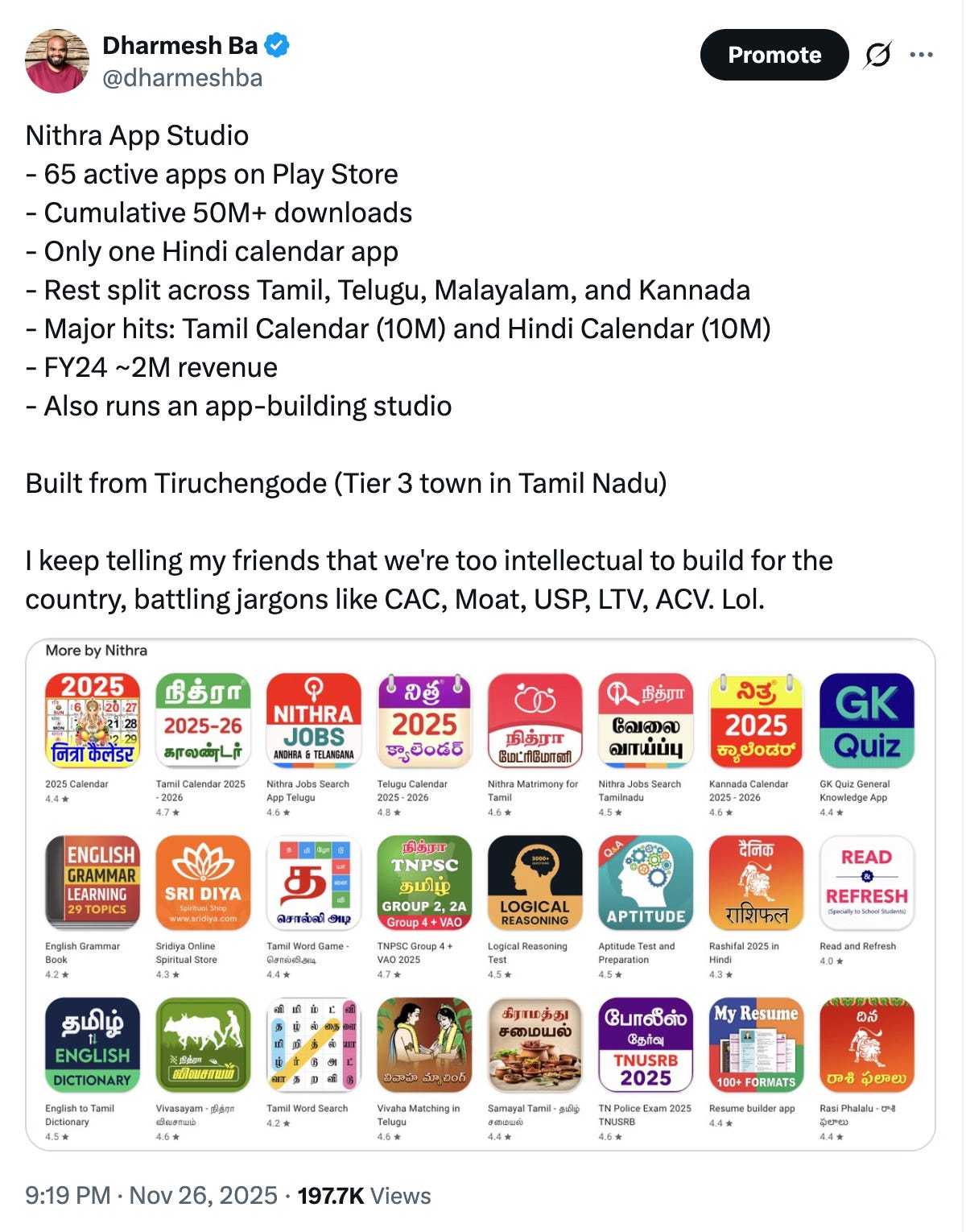

I recently wrote about Nithra App Studio, built out of a small town in Tamil Nadu, quietly doing around $2 million in revenue.

All these companies are building a portfolio of low-cost bets that capitalize on impulse and ease and I expect to see this trend surge in 2026.

2. Banking with a vibe

One of the interesting things about a bank like HDFC is that it emerged in the mid‑1990s as a technology‑driven private sector bank that focused on convenient, computerised retail banking. In earlier years, many employees, especially in traditional sectors, often received salaries by cheque and had to visit branches to encash them, which could mean losing work time. As electronic salary credits and corporate salary accounts became more common, HDFC Bank actively partnered with companies to open salary accounts for employees, who could then access their money through ATMs, debit cards, and later digital channels. During the IT boom, HDFC Bank was one of the major banks used for salary accounts by large IT and services companies, so it became a default transactional bank for many IT professionals, alongside other private banks.

But history is just that - history.

Today, if you ask a Gen Z consumer to think about “tech banking,” HDFC is not the first name that comes to mind. It holds the banking license, but it no longer holds the mindshare.

If I were the CEO of a traditional bank, I would be terrified. The most frequent interaction a customer has with a bank - payments - has been completely ceded to Google Pay and PhonePe. Credit cards are now synonymous with fintech brands like CRED. Investments? That’s Zerodha and Groww. The traditional bank has been reduced to a backend utility, visited only for the most mundane transactions. Funnily enough, even when you try to redeem credit card points, many banks redirect you to a clunky third-party website. It is a broken user experience.

The problem runs deeper than UX. Banks historically made money on big life milestones: buying a home, buying a car, starting a business. But the definition of a “life milestone” has shifted. Gen Z isn’t dreaming of a 30-year mortgage or a sedan in the driveway. They long for experiences and memories - travel funded by EMI, concert tickets on BookMyShow, and instant buy now pay later checkout on e-commerce sites.

In those moments, traditional banks rarely come to mind.

I saw a viral reel recently that summed this up perfectly. A young woman walked into a bank for the first time to deposit cash. When asked for her account number, she read out her debit card number. She had no idea there was a difference. And why would she? She receives her salary in the bank account and spends it via UPI. She lives in a digital world where visiting a physical branch is a chore.

Source: Chaiyeahhhh on Instagram

Banks still feel necessary. Rarely memorable. In the coming years, I expect traditional banks to fight aggressively for relevance. We will see app redesigns, not just for utility, but for personality. It is no longer enough to have a banking license; you need a brand that stands out like Zomato or Swiggy - quirky, digital-first, and omnipresent. The battle for 2026 won’t be about who has the most branches. It will be about who has the best vibe.

HDFC’s new design makeover could be the first step towards it.

3. AI family member

I was recently watching Varun Mayya’s series on business “Katas” - a concept borrowed from martial arts. In the first kata, he talks about how he built the AEOS ecosystem and what his original vision looked like a three years ago.

He said he started asking people a simple question: What’s the last new app you downloaded? Most people struggled to answer.

Then he asked a different question: Which new creator or content did you start following recently? This time, names came quickly.

Distribution, he realized, had shifted. People weren’t discovering products anymore. They were discovering people. Content had become the front door.

That idea has been sitting with me for a while. What is the next thing people will want to interact with? The obvious answer everyone is circling around is AI companions.

Over the last few months, I’ve had several founders pitch me versions of this idea. Most of them sound similar at a distance: a chatbot that talks to you, remembers context and feels like a friend. Most narrow it down to astrology, English learning, dating or interview prep.

But the challenging part isn’t the technology. It’s the relationship.

If you’re building an AI companion, you’re not really building an app. You’re introducing a presence into someone’s life. Which means you’re forced to answer questions most software never has to.

Who is this to the user?

Is it a teacher? A sibling? An uncle? A manager? A colleague you grab chai with? In an Indian household, these distinctions matter deeply. Relationships are layered, emotional, hierarchical, familiar.

A transactional AI can be useful. It can help you crack an interview or learn English. But usefulness alone doesn’t create memory. You don’t form attachment to a syllabus. You build one with a teacher. You remember the person who helped you through it. Relationships don’t live in one place. They follow you. They’re available when you need them.

The closest analogy I can think of is note-taking tools.

Evernote was never just an app. It was a system. Notes live everywhere - on your phone, your laptop, your browser, your watch. They’re not a destination; they’re an extension of how you think. A quiet mirror of your inner world.

AI companions will likely evolve the same way. Different shapes. Different entry points. Voice, text, apps, maybe something we haven’t named yet. Not platform-specific. Ubiquitous.

I don’t know what the final form looks like. No one does.

But I’m fairly certain about one thing: the AI companions win because they understand relationships. I mean don’t expect Wall-E types but we should at least start with Wall-A

4. Bringing back a purpose

I keep thinking about the evolution of the Indian family structure, specifically a massive, unaddressed void that emerges later in life. There are two distinct cohorts who, beyond a certain point, feel a profound sense of loneliness and a desperate need for purpose. And What strikes me is how little we build for them.

The first group is women who have spent most of their lives raising children and holding families together. The first 15 to 18 years of parenting are all-consuming - physically demanding and emotionally exhausting. In the process, many of these women lose their sense of self because they have lived entirely for others.

Then, the kids leave for college. Suddenly, they are faced with the question: “Who am I?”

Many of these women were exceptional in another life. Gold medalists. Class toppers. And yet, they wake up one day realizing they are unseen, undervalued, and financially dependent for even small decisions. To make it harder, they look at Instagram and see a different generation of women - those who delayed marriage, built careers, and found financial independence. Seeing this “road not taken” can trigger a painful realization of what they missed.

By the time this realization arrives, returning to the workforce feels almost impossible. Almost - but not entirely. They don’t just need a job; they need reskilling and, more importantly, confidence.

Here is the hard truth: It’s rarely about the money itself. It is about the dignity that comes with earning. Having an identity outside the home earns respect from in-laws, husbands, and children. It validates their existence. India has one of the lowest female labor force participation rates in the world. Building for this demographic isn’t just a business opportunity; it is a societal imperative. You have to start with the people and build the economy around them, not the other way around.

The second cohort is the retired. Life expectancy in India is rising. Suddenly, at 60, people find themselves facing a potential 20-year vacuum. The children have flown the nest to run their own “rat race,” often in different cities. Grandkids are a rarity. They have a body that feels old, but a mind that still feels young.

Everyone is trying to solve for “senior living” - healthcare and retirement homes. But very few are solving for “senior purpose.” The worst thing you can do to an older person is make them feel old. You have to make their life feel relevant and meaningful again.

How do you build for that? It can be surprisingly simple. I love the app Habuild. It turned yoga into a daily habit. A friend’s father, in his early 60s, has been using it for three years. It tracks his progress and sends a Duolingo-style streak right inside whatsapp.

5. Discipline monitor

A few years ago, during my field visits, if I asked people where they learned something, they could usually tell me. They had a source. They could point to a book, a website, or a person.

That has changed. Today, the answer is almost always “I saw it on Instagram” or “I saw it on YouTube.” But if you press for details - who posted it? what was the channel? What was the specific argument? - you are mostly with a blank stare. “It just came on my feed.”

The source has vanished. Only the vague impression remains. We have lost the ability to trace information back to its roots, to stick with a topic, and to go down the rabbit hole. We have lost the friction required for deep learning.

We have entered the era of “brainrot” and microdosing. Watching a 30-second reel about starting a business now provides the same dopamine hit as actually starting one. Watching a video on fitness feels like working out. Every lifestyle feels attainable on a screen, yet taking the first step in the real world feels impossibly hard.

Apps like Seekho capitalize on this. They sell the feeling of productivity. Subscribing to a course tricks your brain into thinking you’ve taken action.

We will see a rise of business models that don’t just sell information, but sell discipline. “Coaching for adulting,” if you will. Whether it’s preparing for an exam, saving money, raising a kid, or building a home, people are going to pay for someone to hold them accountable.

“Be my daddy” could mean something else in 2026 👇

Source: harshitchajjed on Instagram

I have consciously kept these themes simple, drawn from what I have observed on the ground. For a more sophisticated macro perspective, I highly recommend reading Tigerfeather’s predictions for 2026.

What’s next for me?

I don’t know exactly where all of this leads.

I do know what I want to spend my time on. Writing more. Doing deeper work on Indian consumers. I have a lot planned for 2026: launching a YouTube channel to explore these themes visually, starting a course called “The Field School” to teach founders and product managers the art of observation, and scaling my consumer insights firm, 1990 Research Labs.

My goal is simple: to dig deeper into the Indian consumer story than anyone else.

I’ll keep sharing what I see as the months go by - ideas that come from conversations, and field visits. If there’s something you think I should look at more closely, or a question you’re carrying into 2026, I’d genuinely like to hear it.

Let more life happen in 2026. Happy New Year :)

If you liked these predictions, consider sharing with a friend or a colleague that may enjoy it too. (If you share on socials, tag me. I’m on Twitter (X) and LinkedIn)

Loved it. Sorry to hear abt the startup challenges you had. But glad we have you writing and sharing these with us. Looking fwd to the YT channel.

What I found interesting:)

"Low-ticket pricing, combined with UPI auto-pay, has opened up an entirely new set of business models. You see it in English learning apps, micro-drama platforms, social and companion apps. We are seeing this work brilliantly with apps like Seekho, SpeakX, Lokal and FRND. They offer services with high perceived value - like learning a language or upskilling - for a nominal monthly fee. With AI the economics works out at scale. It lowers the cost of creating content, testing creatives, and iterating fast. Meta ads becomes the acquisition layer. The user loop is simple: bombard them with short-form ads, funnel them to the app, and close the sale with a ₹1 trial. If the user sees value, the auto-pay kicks in. If they don’t, the loss is negligible. What fascinates me is that the exact product almost feels secondary."

"Banks historically made money on big life milestones: buying a home, buying a car, starting a business. But the definition of a “life milestone” has shifted. Gen Z isn’t dreaming of a 30-year mortgage or a sedan in the driveway. They long for experiences and memories - travel funded by EMI, concert tickets on BookMyShow, and instant buy now pay later checkout on e-commerce sites. In those moments, traditional banks rarely come to mind."

"Everyone is trying to solve for “senior living” - healthcare and retirement homes. But very few are solving for “senior purpose.” The worst thing you can do to an older person is make them feel old. You have to make their life feel relevant and meaningful again."

Hi Dharmesh, as a founder and an entrepreneur for 20 years i hard relate to you and sending you tons of positive vibrations…

Your Nithra example sparked off something in me again..

I am an animation film maker and currently trying to navigate the treacherous waters of making animation content for adults Indians. I often wonder how can I make content that can be consumed by the whole country while I am a privileged english first citizen who has only limited connection to the billion odd population that I want to watch my animation series. I can make stuff for the 5% of the population , sure thing but what about the rest. I don't relate to 90% of what goes in the name of entertainment in this country. The only solution I resonate with is making something with enough depth and honest humanity (disguised as entertainment) that touches each strata of society…

Would love to hear your perspectives..

Cheers,

Vivek