Where do Indians borrow money from?

Read time: 7 mins

A mandi is a place where vegetable cart vendors pick up their veggies in bulk to sell them later in the day. But it also serves as a place where they could borrow money to buy the vegetables. From whom? The moneylenders. The moneylenders are individuals or groups who lend out small ticket-sized loans for a day without any paperwork hassles. For every Rs. 100 borrowed in the morning, they repay Rs.102 by the evening. Though paying Rs. 2 extra per day might seem like a small number, it amounts to 2% interest per day. If you calculate the interest rate annually, it will amount to a whopping 720% per year. To put that in perspective, if you and I walk into a bank branch, we could get a personal loan at 11-18% P.A. The intriguing part is that many who borrow these one-day loans at a massive interest rate dont really complain about it. Read on to understand this peculiar behaviour. Let’s look at where do Indian borrow from?

In the previous newsletter, I discussed the investment behaviour of Indians, which was a synopsis of the RBI household finance report published in 2017. As a continuation, in this post, I will talk about the borrowing patterns of Indians with data picked up from the same report.

Too long, dint read? Download this post as a PDF and read it in your leisure time

Liabilities in Indian households:

This report classifies the liabilities or the debt portfolio of the Indians as the following.

1. Mortgage includes loans borrowed using land or real estate as collateral.

2. Secured debt includes loans with assets as security such as loans using crops, shares of companies, government securities, durable goods, or insurance policies.

3. Gold loans use bullion or the gold bar and the gold ornaments as collateral.

4. Unsecured loans are from the moneylenders, family and friends, credit cards and overdraft facilities.

Though most Indians invest in real estate as an asset, the mortgage percentage is relatively minor. Only 23% of the total liabilities are in Mortgage. Around 7.6% of the liabilities are borrowed as gold loans, and 13.4% of the liabilities remain secured debt. The most surprising fact is that the remaining 56% of the debt is unsecured loans.

So, what does this indicate?

One could argue that most of them would have paid off the loan or bought the home without a loan. That’s one side of the argument, but I also believe there are two other important reasons for this behaviour of low Mortgage levels:

1. The strict requirements for a home loan make many low and middle-income groups not borrow the home loan and resort to borrowing unsecured loans to buy land and properties.

2. The second one is the purchase of real estate using unaccounted money. It’s an open secret that purchasing real estate is one of the most popular ways to convert unaccounted cash into assets.

Now let’s talk about gold. Indian households hold more gold than many other countries in the world. Though gold contributes to 23% of the assets in Indian families, gold loans occupy only 7% of the debt portfolio. This indicates that most of the gold lies idle in the households and are’’t monetised enough.

Home and gold are more than just assets; they act as a social signal to the community about life progress. Hence pledging these valuable assets to borrow money is signalled as a sign of financial stress in the family, and therefore it is considered taboo.

Debt: India 🇮🇳 vs other countries 🇨🇳 🇺🇸 🇹🇭 🇬🇧 🇦🇺

In this section, let’s compare the borrowing pattern of Indians with other countries.

Interesting observations from the above graph:

- Mortgage debt: The developed countries like U.S., U.K., Australia and China have almost 50% of the outstanding debt, whereas Thailand and India lag behind the rest of the nations.

- Gold loans: Gold is a unique asset to Indian households. Even a gold loan (i.e.) a loan against gold jewellery is a great debt instrument found only in India and does not feature any other country’s liabilities.

- Secured debt: Thailand has the highest secured debt. If you remember, Thailand had the highest number of durable goods, and we could see that the country has the highest levels of secured debt, which I believe correlates. At the same time, India has lower secured debt penetration than other countries.

- Unsecured debt: It’s not surprising that India has the most unsecured debt ratio. Why do Indians borrow from unsecured sources? Let’s deep dive further

The unsecured borrowing behaviour:

If you are from a low-income household, the bank is not a place that makes you feel welcomed. I’m not talking about the premium banking experience where the relationship manager calls to ask you about your well being and offers you a loan for no reason. I’m talking about a banking experience where one maintains a minimum balance and are categorised by the financial institution as a non-creditworthy customer. Many lack a formal credit score.

Bureaucracy, massive paperwork, lack of respect at the bank are a few reasons people don’t prefer a bank. But the most important thing is the traditional financial institutions haven’t yet figured out a way to underwrite people with low physical assets and create customised products for them. Imagine the cart vendor walking to a bank branch to borrow a loan for his daily business operations. This is where the informal money lending business thrives. They provide the loans at the required place and time with no paperwork.

Providing access to these small loans makes the borrower faithful to these moneylenders. I’m not supporting the business of moneylending, but I’m stating the social structures which have made money lending a thriving business.

State-wise borrowing behaviour

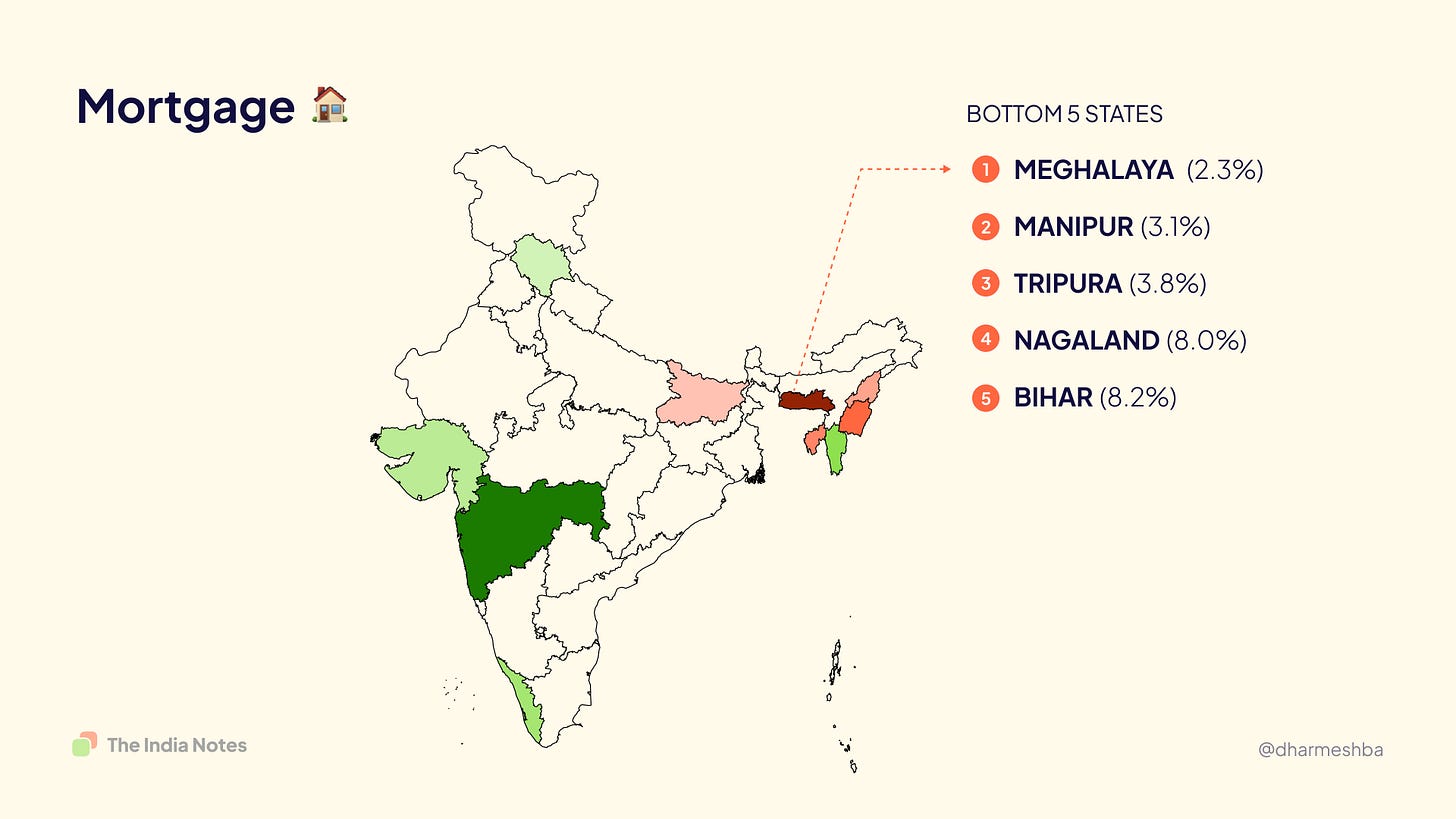

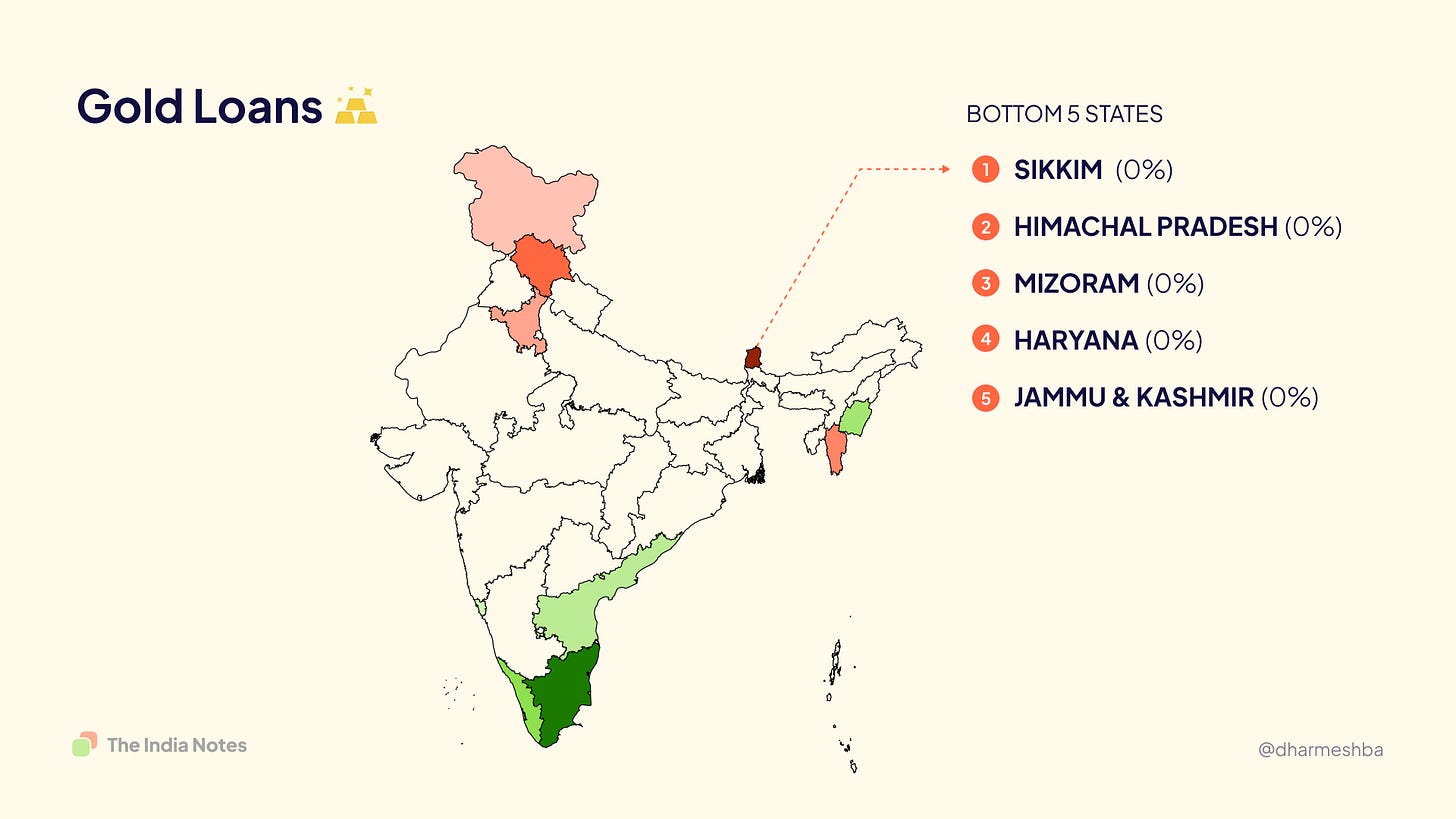

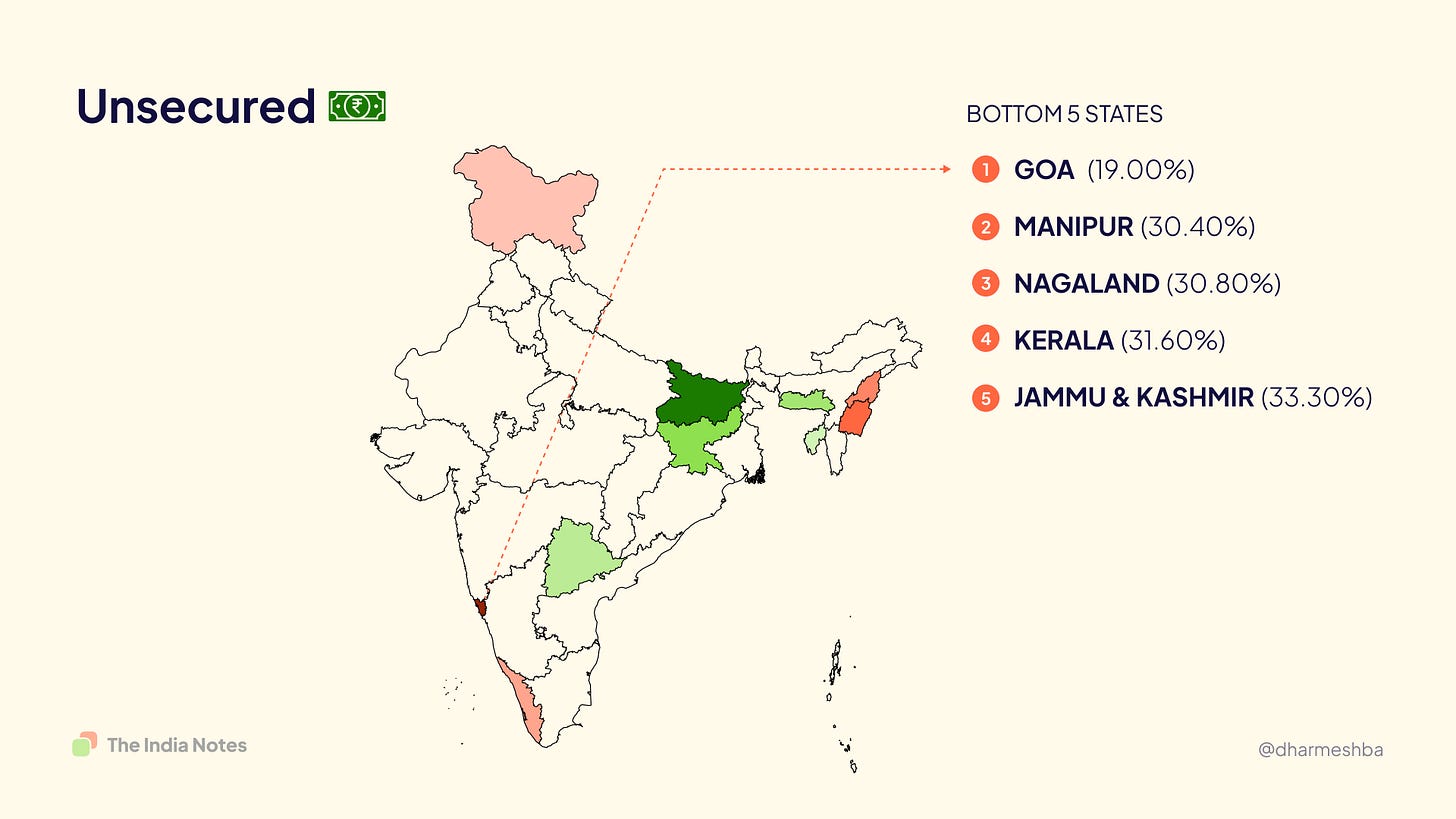

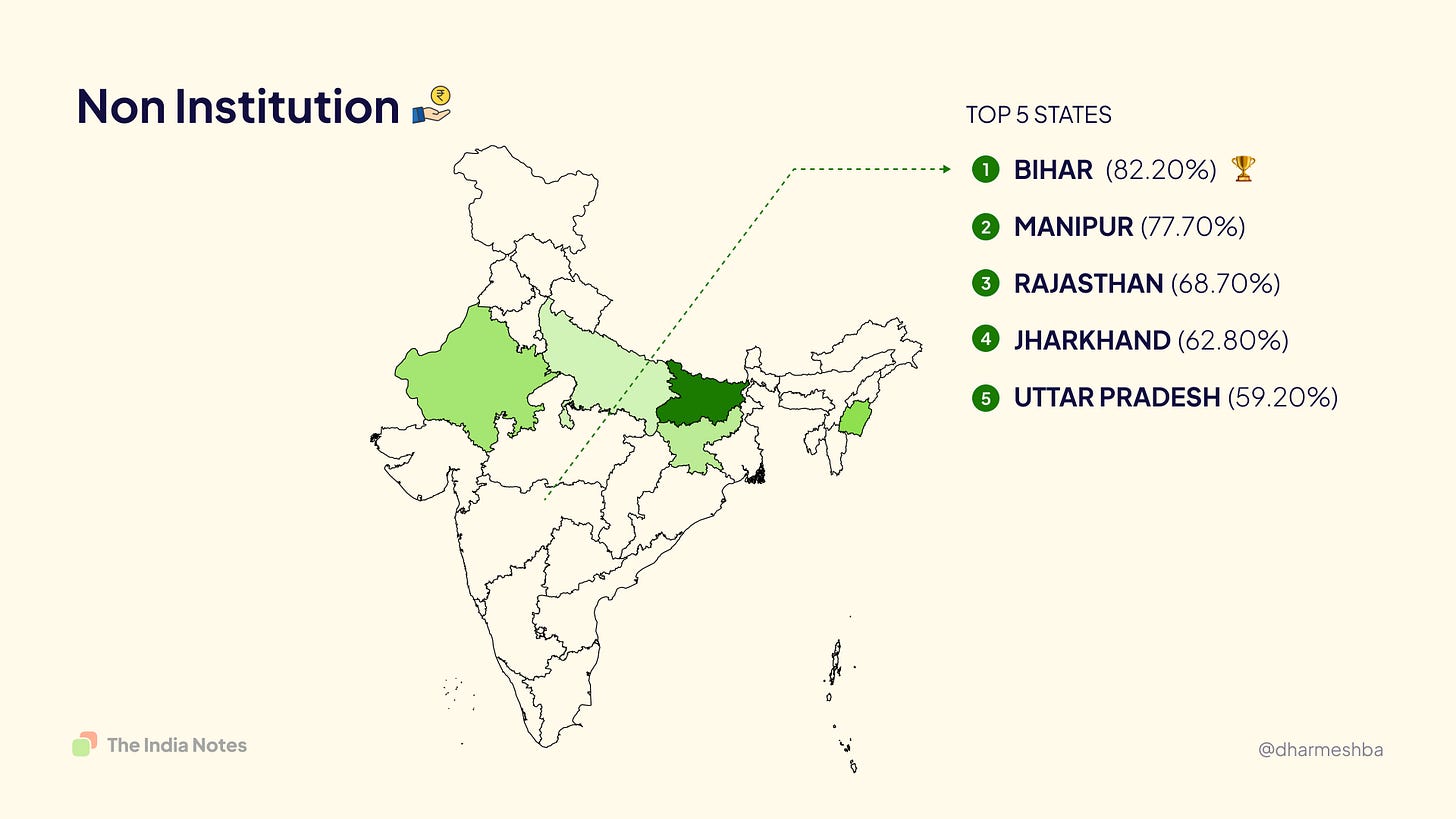

The following graphs illustrate the top 5 and bottom five states under their corresponding liabilities. For example, Maharastra 47% in Mortgage means that of all the loans that an average Maharashtrian owns, 47% of it is a mortgage (or home loan).

Mortgage: Top 5 states

Mortgage: Bottom 5 states

Gold Loan: Top 5 states

Gold Loan: Bottom 5 states

Unsecured: Top 5 states

Unsecured: Bottom 5 states

Non-institution: Top 5 states

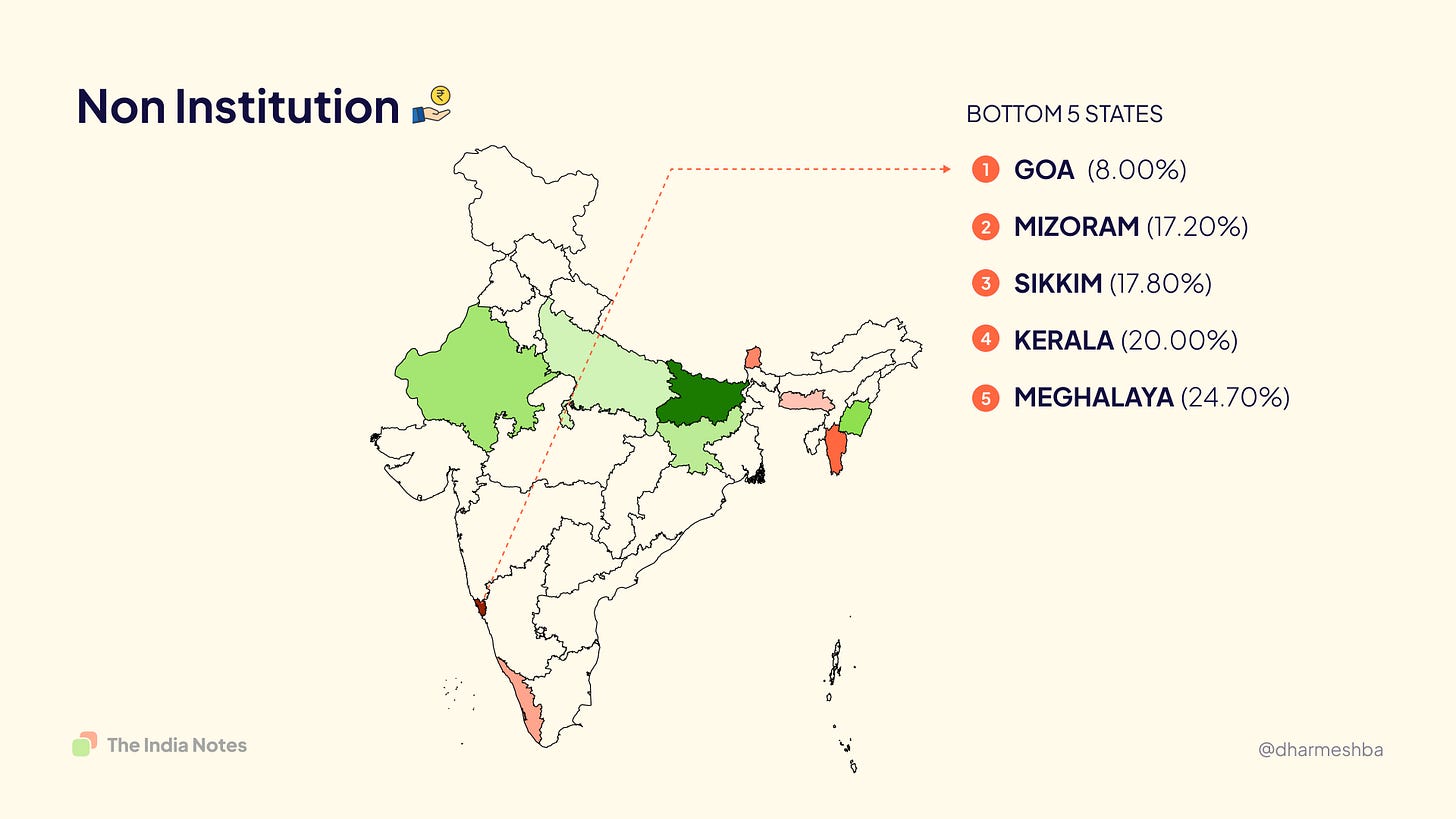

Non-institution: Bottom 5 states

What does this mean for India?

I firmly believe the mobile-first lending apps will bridge the gap in unsecured lending through underwriting based on data footprint. But most importantly, there would not be another human being to give you a judgemental stare for your reason of borrowing. Digital-first lending is a massive opportunity, but it also comes with great responsibility.

References:

RBI Household Finance Report, 2017

If you like this, then you might like:

- Where do Indians invest their money?

- Designing better user accounts for India.

- Are human emotions neglected in fintech?

Got feedback? Reply to this email and happy to hear you out. If you find this interesting, share this with your friends and colleagues.

One other avenue where Indians get money from is chit funds. It might not look like a loan per se. However, the auction amount spent of redeeming the chit at an earlier stage might be very high (is similar to the interest) which doesn't bother the people. And like daily lenders, there are chits that do daily collections.

Although users are uncomfortable going to banks but they still seem to want the trust stamp coming from banks or any similar reputed institutes .. How do you think digital first lending apps can you language to bring in trust on their apps ?