Why don't Indians buy enough insurance?

A dive deep into the behavioural and cultural factors contributing to the lower adoption of insurance.

I first learnt about Insurance through a Rajinikanth movie. Yes. Sounds funny. 'Aarilirunthu Arubathu Varai' (From six to sixty) is a 1979 movie that narrates the journey of a lower-middle-class man who struggles to get a good life for his three siblings. As each sibling grows up, he borrows money at exorbitant interest rates to pay for their marriage and tuition fees.

There is a beautiful scene where Rajini's wife recommends he start saving money through a monthly LIC insurance policy to support the family in any unfortunate instance. To this, Rajini replies

'Do you really want to live off the money from my death?'

The scene follows a wife's closeup shot, a shocked face and high pitch BGM trying to evoke an extreme emotion of shock.

As a kid, I was intrigued when I watched this scene on TV. Insurance is a means of protection from uncertainty.

Insurance is classified as life insurance and non-life Insurance (health, motor, home, travel etc.). Insurance penetration is measured as the percentage of total insurance premiums paid in a year to the country's GDP.

As of 2020, the life insurance penetration in India is at 3.2%, closer to the global average of 3.3%. But the numbers look weak when in the non-life insurance segment. The non-life insurance penetration is only around 1% compared to the global average of 4.1%.

Why is there a low uptick in insurance?

I stumbled upon exciting data points to uncover the answer to this question. Selling insurance in India is complex. Insurance provides a hedge against an individual's risk. Hence to purchase insurance, one should come to terms with the fact that life is uncertain, and they need protection at all costs. We build mental models to navigate life from our past experiences or the experiences of the people around us. Hence for a healthy individual, it becomes challenging to explain the importance of health insurance.

For teenagers, it is hard to visualise the value of life insurance.

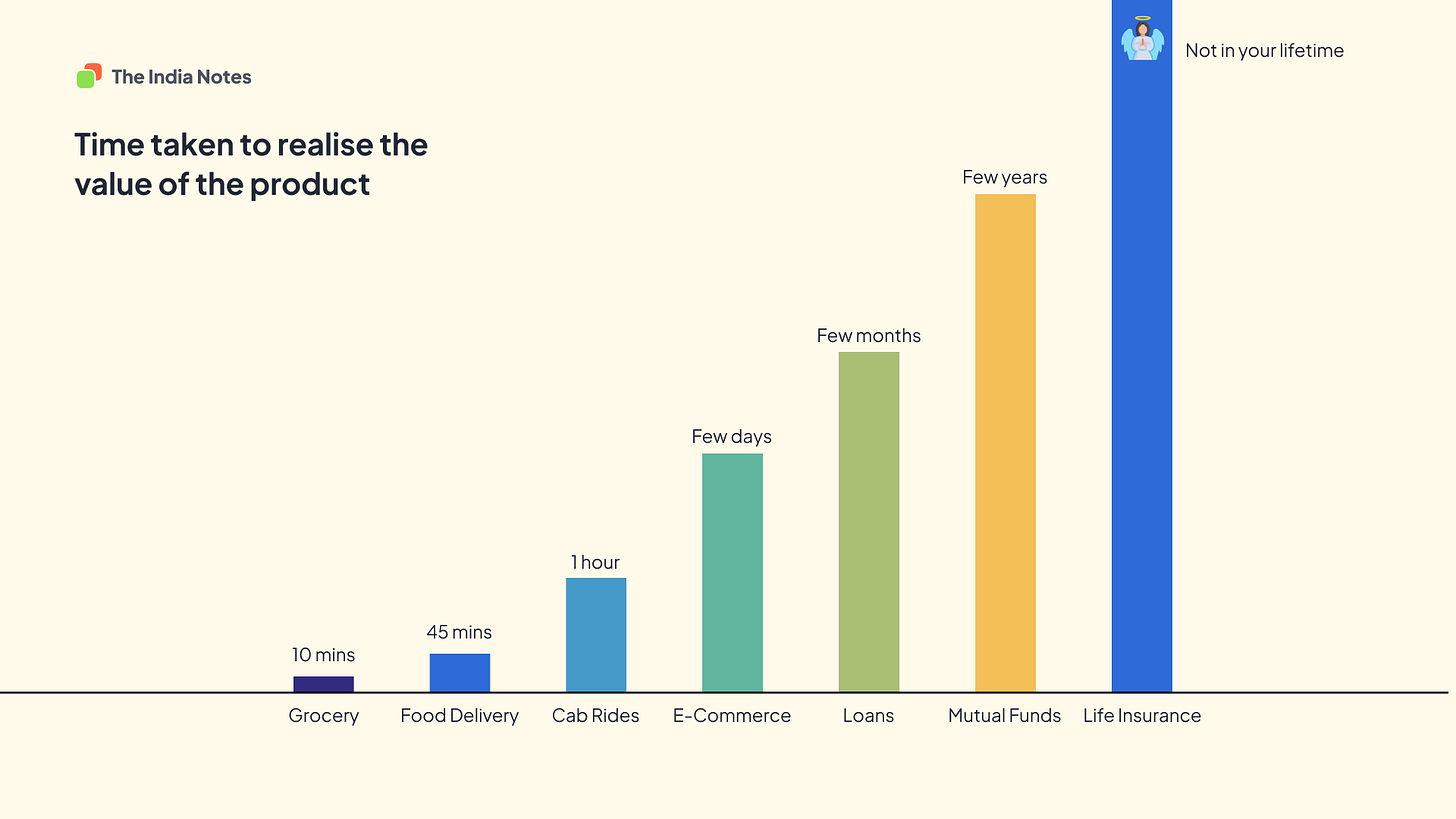

I have a funny way of thinking about this. The time taken to realise the values for most products and services ranges from a few minutes to a few years. For example, ordering groceries takes 15 mins to reach, or mutual fund investments take a few years to realise the profit.

But a product like life insurance takes a lifetime (quite literally). One might not be alive to realise the value of the product.

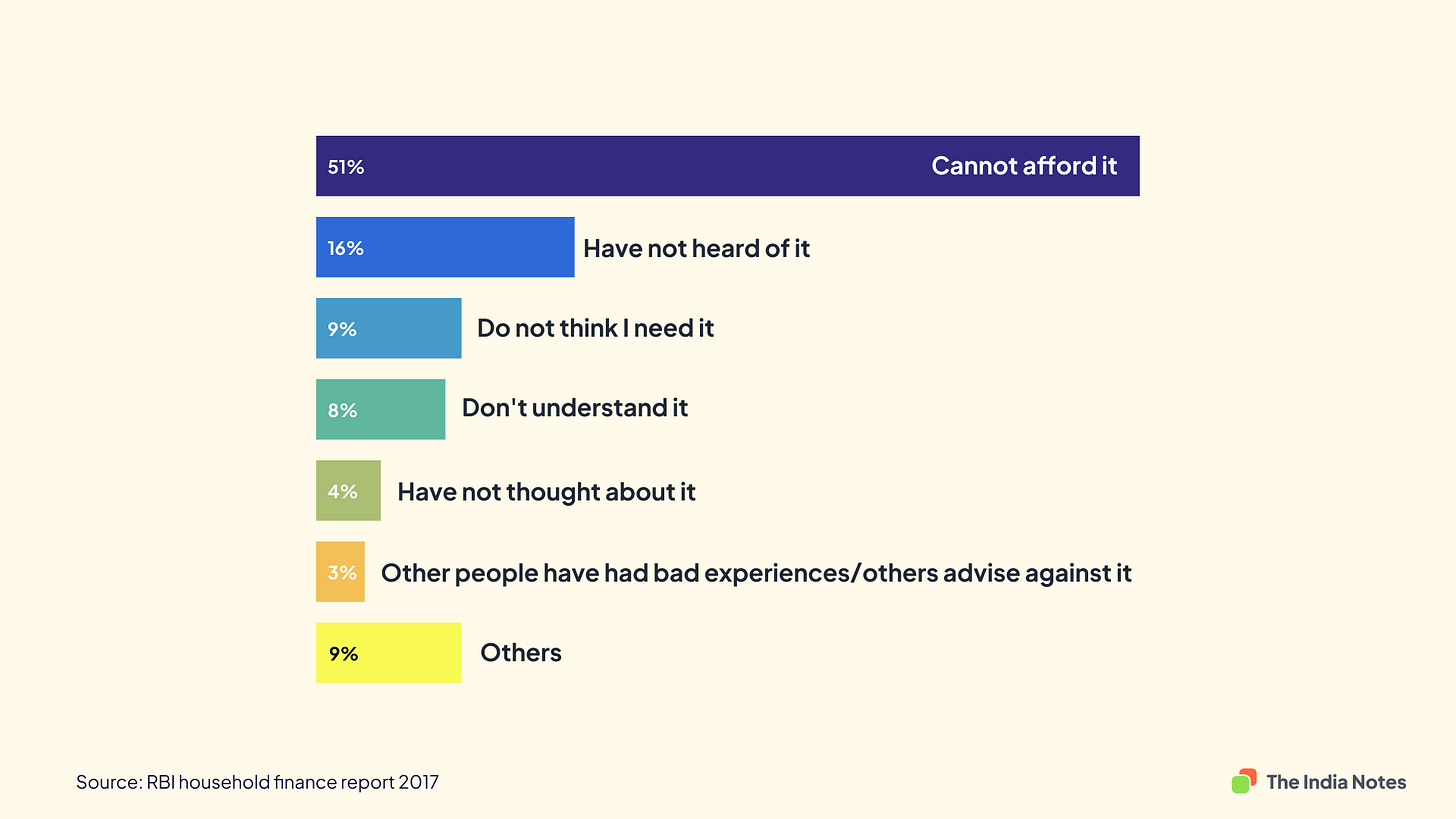

The RBI Household Finance report illustrates the reasons for low insurance purchases in India:

Let's deconstruct the top 5 reasons and the motivation behind those statements.

1. Cannot afford it:

India's per capita income is $2277 (Rs.1.82 Lakhs). Family investments and insurance become a luxury in a low-income household where most money goes into spending on basic amenities like fuel and groceries. Even when the households start their insurance journey, the compulsion to pay monthly or periodical instalments become a burden. India has only about 8.22 Cr income taxpayers out of 130 Cr population. Most Indians are self-employed and do not have a regular flow of income. The irregular flow of income makes it challenging to continue a journey which expects you to pay monthly/quarterly instalments. When they skip the insurance premiums, the policy lapses, and they might have to start their journey again.

2. Have not heard of it:

Lower insurance awareness has a second-order effect on borrowing emergency loans. When individuals are not insured enough during a crisis, they resort to borrowing loans from friends, family, money lenders etc. These sources of borrowing usually have a high-interest rate. Though the money borrowed within the family does not have interest rates, it might have social obligations for the family members in the future, which are usually not accounted for.

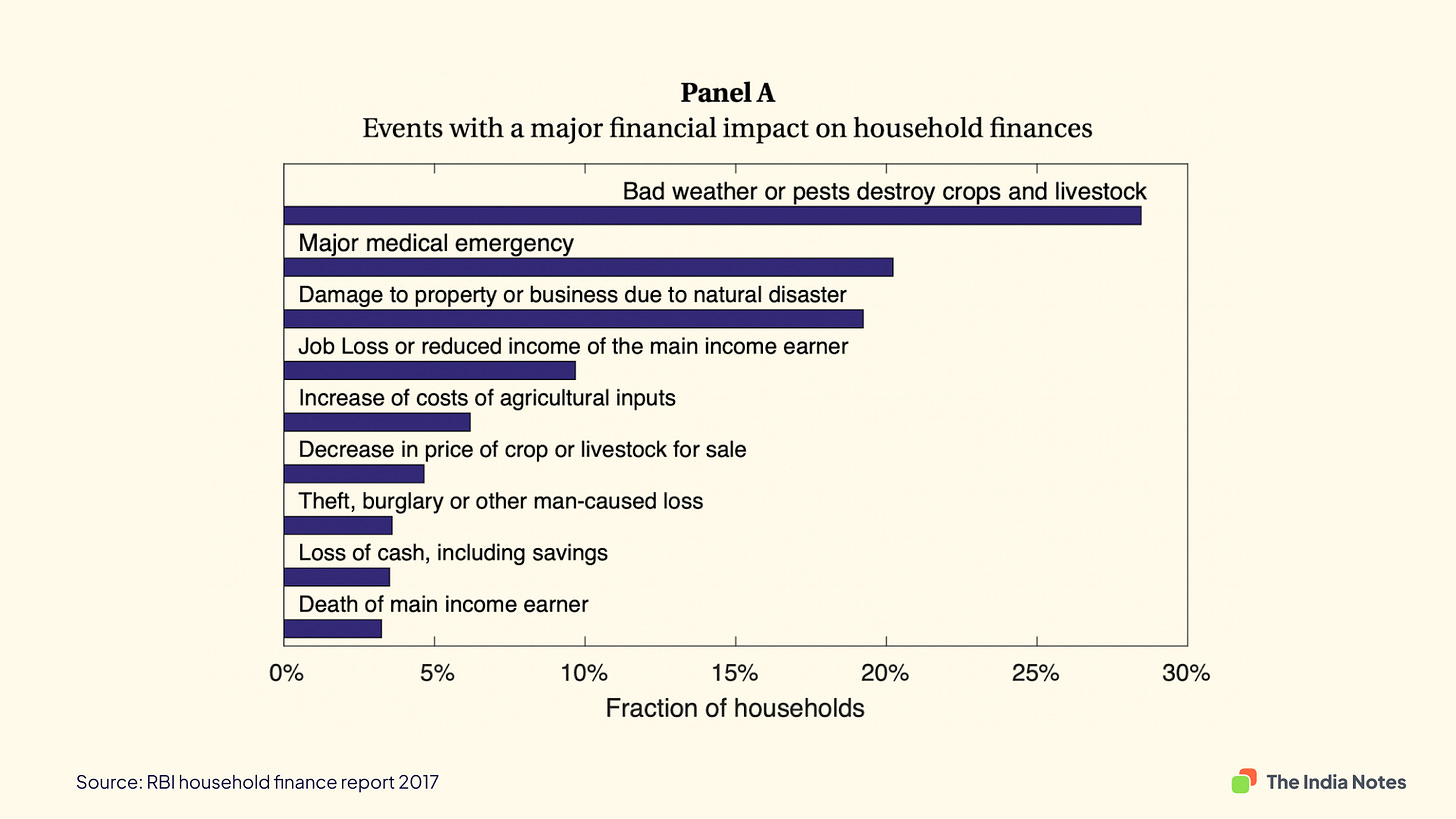

Some of the events with a major financial impact on household finances

And the sources of emergency funds

3. I don't think I need it. / Have not thought about it:

Change is hard to adapt for people. Status quo bias is where people prefer that things stay as they are or the current state of affairs remains the same. We wish our life continues smoothly, and we believe nothing wrong will happen in the future. A common anecdotal misunderstanding is that 'If I stay healthy and keep my body fit, I wouldn't need insurance. COVID is a black swan event. No one predicted it. But the collective suffering made us think about an uncertain future, and life is short. The massive uptick in life insurance in India is a testament to it.

According to a Google India report, there was a 44% increase in search for 'Health insurances for families' in 2021

4. I don't understand it:

Buying insurance is a complex process. The overwhelming choices, paperwork, and hidden clauses make choosing the best-suited policy challenging. With massive insurance commissions to the agents, the brokers selling the insurance products could mislead the individuals. Being transparent and reducing choice fatigue could solve this. Better control over the information makes individuals feel control over their life.

5. Others had a bad experience:

Negativity bias is the human tendency to give more importance to negative experiences than to positive or neutral backgrounds. Insurance companies rely on the fear of an uncertain future for the sale. Hence, the buyers need to trust the insurer to cover the risk during a crisis. In the lack of appropriate evidence, they resort to anecdotal statements from their community to make decisions. Moreover, negative experiences spread faster than positive ones.

These problems present an exciting opportunity for the new incumbents to make an impact. The insure-tech sector is booming in India. In 2021, the industry saw an inflow of 800 Mn in funding. India has three insure-tech unicorns (Acko, GoDigit and PaisaBazaar)

The recent insure-tech and trends report outlays five prominent themes that would improve insurance penetration in India.

The emergence of new customer segments (MSME, Women, Tier 2 cities)

Digital as a driver for higher penetration, distribution and growth.

Emphasis on enhanced customer experience as a differentiator.

Leveraging data analytics to drive innovation and personalisation.

Government's push via Nation Health Stack

Before I conclude, hear me out on the movie plot twist of the movie I discussed at the beginning. Rajini grows old, debt-ridden and is left alone by his siblings. He is pushed back into poverty because he mishandles finances and has an over-reliance on his siblings to pay back the debt. He is at a point where the family does not have money to feed his children. In such a situation, his wife passes away in a fire accident. The next day an insurance agent comes home and hands over a cheque for a large sum as his wife had secretly been paying the premium without the husband's knowledge.

Does this movie sound dramatic? Old school? A trip outside our social circle can show us that reality is not very far from this fiction.

Have a great day. Subscribe to 'The India Note' for weekly discussions on consumer behaviour in India.

References:

If you are interested in diving deep into insurance penetration, I highly recommend the following reports.

Very nicely written up! Most insights were so relatable. I have just moved back to India and see a lot of these things at play. But also some major shifts in how the older generation orders. My parents don't like eating out as much either. But they use swiggy to order sweets and samosas when guests come home. And they share that as a matter of pride to show they are keeping up with times :) i have rarely seen them order a full meal though. It's always snacks and sweets.

Very insightful. Thanks for writing it down